Melbourne Landed Homes: A Fraction of Singapore's Prices!

10-Oct-2024

Melbourne vs. Singapore: A Decade of Property Growth

If you've been observing property trends in Singapore, you're well aware of the challenges that come with purchasing a landed property in the city-state. Prices have surged over the past decade. But what if I told you that there’s a place where you can afford a landed property with just a million dollars? Melbourne offers exactly that opportunity—a city that’s quietly grown in value yet remains accessible to investors ready to seize it.

In this article, we’re going to dive deep into how Melbourne’s property market has risen, what makes it unique, and how it compares to the soaring Singapore market.

Melbourne House Prices vs. Singapore’s Landed Index: A Comparison

The Rise of Melbourne House Prices Over the Past Decade

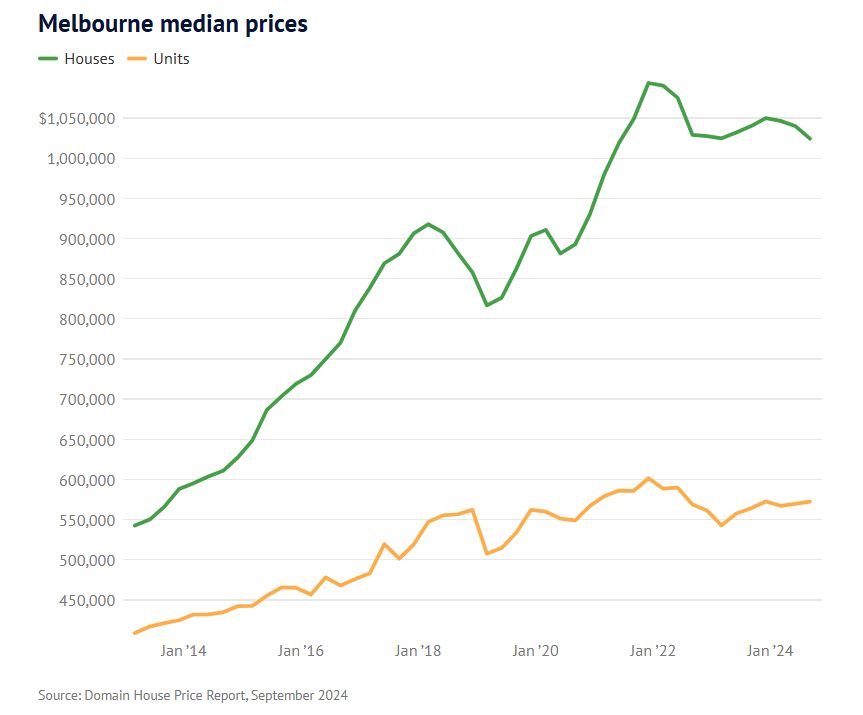

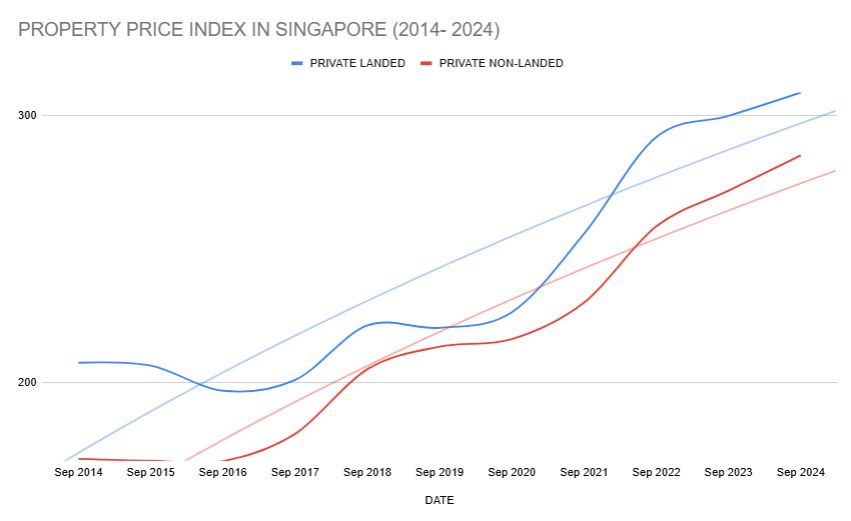

Over the last decade, Melbourne’s house prices rose an impressive 67.7%, while Singapore’s private landed properties increased even faster, up 50.7% since 2014. However, the median house price in Melbourne today is $1,024,000 AUD (October 2024). Just ten years ago, you could purchase a typical house for about $610,000, whereas in Singapore, you’d need around $3 million SGD for an entry-level landed home.

In comparison, while unit prices have also risen—up 31.7% to a median of $572,000—they have not kept pace with houses. This discrepancy highlights the enduring value of land in Melbourne and reinforces the notion that investing in houses is often more lucrative than units.

Why Melbourne Properties Present a Resilient Investment

It’s true that Melbourne’s landed properties are seen as more resilient than high-density options—and perhaps more resilient than Singapore’s too, given the differences in urban planning and market dynamics.

- Stable Demand for Landed Homes

Melbourne’s housing market has a persistent demand for landed homes. A house here is more than just a home; it’s an asset on finite land that sees constant demand.

Advantages of Investing in Melbourne vs. Singapore

3 Tips for Singaporean Investors

By choosing Melbourne, you’re not just buying property—you’re securing a piece of a dynamic, evolving city that offers long-term value.

Imagine a future where you own a property in one of the world’s most liveable cities—affordable, promising, and growing. Don’t let this moment pass you by.