Melbourne Overtakes Sydney as Top Investment City for Asian Buyers

Josh Tay

Last Updated on 08-Aug-2025

Melbourne: The New Investment Hotspot

Melbourne has officially overtaken Sydney as Australia's largest city, making it the new top destination for property investment. This shift has been driven by a surge in Asian investors and a unique blend of demographics, lifestyle, and economic benefits that make Melbourne an irresistible choice for property investors.

Melbourne's Rise to the Top

For over a century, Sydney held the title of Australia's most populous city. However, according to a report, Melbourne has replaced Sydney as Aussies’ preferred city for investing, with Asian investors driving the growth. Melbourne has been named the number two city in the APAC region for investment by commercial property investors, coming in second only to Tokyo.

Melbourne's triumph over Sydney is mainly driven by international investors from Asia, with Australian investors still preferring to invest in the New South Wales capital. Melbourne's popularity is a result of its high potential for growth, with strong rental uplifts forecast across all sectors over the next two to three years.

Melbourne's rise as Australia's "most attractive city" was "due to its stronger rental growth supported by tight vacancy," making it an enticing prospect for investors seeking stable and lucrative opportunities.

Melbourne has become the most populous city in the country following a boundary change, with the latest government figures putting Melbourne's population at 4,875,400 – 18,700 more than Sydney.

Melbourne's rapid growth is largely thanks to international migration, with the city having a reputation for celebrating diversity.

Demographics and Lifestyle

Melbourne's diverse and vibrant lifestyle, coupled with its economic prosperity, has made it an attractive destination for both local and overseas migrants. With a growing population and a reputation for being the world's most liveable city, Melbourne offers a unique blend of cultural richness, employment opportunities, and a thriving real estate market.

Melbourne's rapid growth, which has now made it the most populous city in Australia, is largely fueled by international migration, reflecting the city's reputation for celebrating diversity and inclusivity. Unlike Sydney, Melbourne has been a magnet for migrants, with projections indicating continued growth driven by immigration, compensating for the effects of low birth rates in both cities.

Property Market Outlook: A Lucrative Opportunity

Melbourne's property market has experienced a remarkable turnaround, making it an opportune time for global investors to capitalize on its resurgence. After a decline in housing values, Melbourne has rebounded with a 9.1% increase over the past seven months, signaling a robust resurgence in the property market. This resurgence is further supported by the city's robust auction clearance rates, creating a favorable environment for property investment.

Asian investors have significantly contributed to the growth of Melbourne's property market, making the city an appealing investment destination. The surge in investor-owned listings, which account for 60% of properties in Melbourne, underscores the confidence and interest that Asian investors have in the city's real estate market. The increasing demand for housing from Asian investors, coupled with Melbourne's enhanced liveability, has propelled the city's property market to new heights.

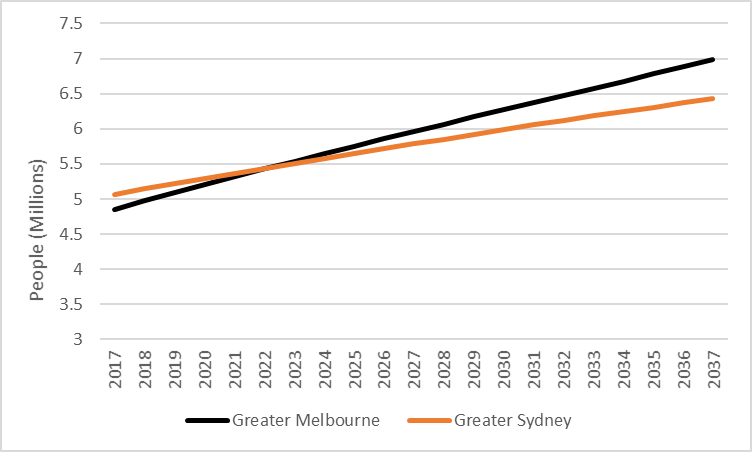

Melbourne is forecasted to become Australia’s most populous city by 2031-32, surpassing Sydney's population by a couple of hundred thousand people.

Melbourne attracted a larger share of net overseas migration compared to Sydney due to past policies from the Victorian government that actively encouraged international migration.

The city's liberal requirements for skilled migrants and economic opportunities for international students contributed to its appeal.

Australians from other cities and towns move to Melbourne at a greater rate than it loses residents to other states, attracted by cheaper house prices and better cost of living.

Recent international migrants who initially moved to Sydney later moved to Melbourne, accounting for about half of interstate flows from Sydney to Melbourne.

Melbourne's larger natural increase in population, influenced by the influx of young migrants, contributes to its faster population growth compared to Sydney.

The city had previously come close to parity with Sydney's population, but definitions used in statistical compilations affect the comparison.

Why Melbourne?

Why Melbourne?Melbourne's property market has demonstrated steady growth over the past two decades, with low rental vacancy rates and attractive median house prices. The city's appeal to overseas migrants and highly-paid knowledge workers further solidifies its position as a prime investment hub. Melbourne's property market has been forecast to continue its growth trajectory, with strong rental uplifts forecast across all sectors over the next two to three years, making it an investment opportunity not to be missed.

Act Now and Seize the opportunity.

In conclusion, Melbourne's ascent as the top Australian city for investment presents a compelling proposition for property investors.

The convergence of demographic trends, lifestyle appeal, and a resurgent property market positions Melbourne as the premier investment destination in Australia.

Melbourne has been named the number two city in the APAC region for investment for commercial property investors, coming second only to Tokyo.

Melbourne's triumph over Sydney is mainly driven by international investors from Asia, with Australian investors still preferring to invest in the New South Wales capital.

Melbourne's popularity is a result of its high potential for growth, with strong rental uplifts forecast across all sectors over the next two to three years. The city's rank as the preferred destination for cross-border capital improved from eight in 2017 to second in 2018, surpassing Sydney, whose rank fell from first to sixth.

Melbourne's rise as Australia's "most attractive city" was "due to its stronger rental growth supported by tight vacancy". The city's appeal to overseas migrants and highly paid knowledge workers further solidifies its position as a prime investment hub.