Melbourne or Perth – Where Should You Really Invest

Josh Tay

Last Updated on 08-Aug-2025

Recently, some of my clients approached me to inquire about the property market in Australia, and one of them is interested in Perth because one of her friends invested in Perth.

With so many options available, I understand that deciding where to put your hard-earned money can be overwhelming.

Perth is undoubtedly an attractive option, with its laid-back lifestyle and stunning natural beauty.

However, when my clients ask for recommendations, I can’t help but suggest they take a closer look at Melbourne instead.

Why? This article will address these questions.

Today, I want to share with you why Melbourne should be your top choice over Perth.

Whether you're a global investor or a savvy Singaporean looking to diversify your portfolio, this article will show you why Melbourne stands out as the ultimate choice for property investment.

Perth's Recent Rise: A Closer Look

It's true, Perth has seen significant growth, but this increase is largely a correction from a previous downturn. Over the last decade, the Perth market was relatively flat, with prices stagnating due to various economic factors.

However, several key fundamentals have emerged to drive the current growth, making it essential for investors to understand the underlying dynamics.

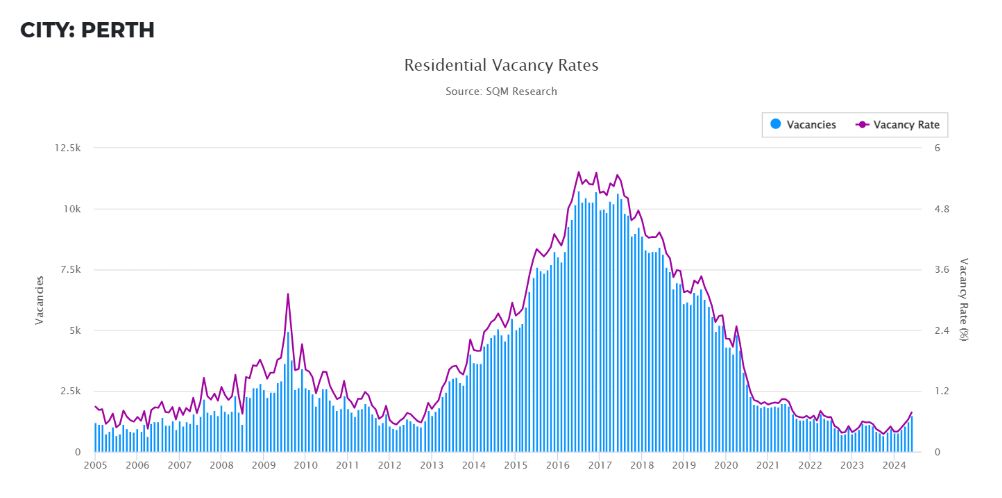

SUPPLY AND DEMAND IMBALANCE

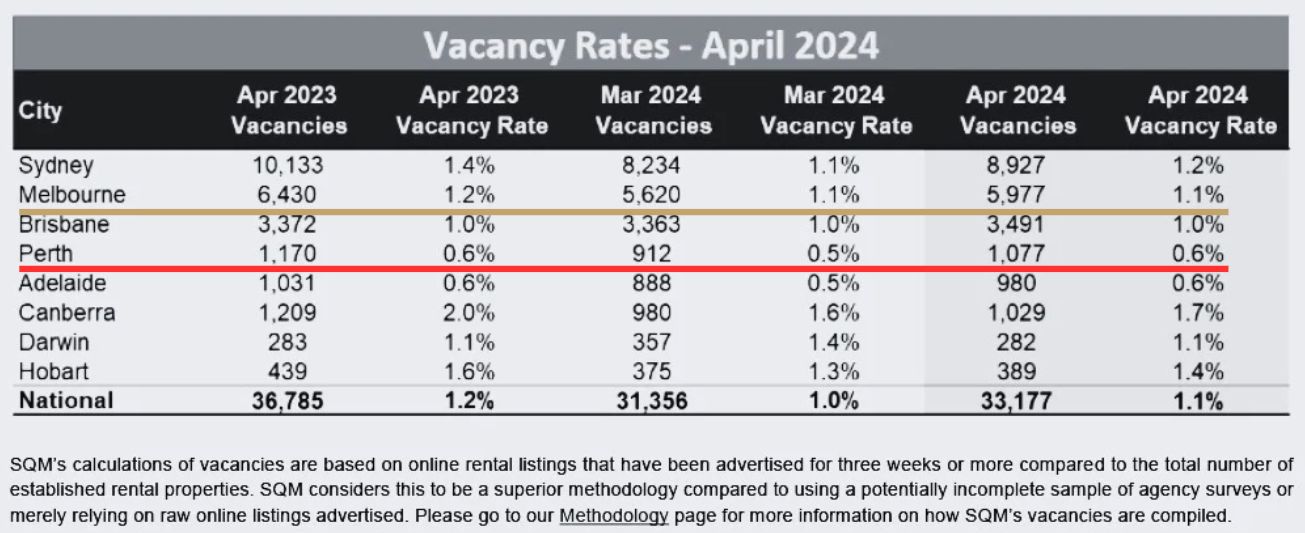

The current housing supply crisis is a critical factor driving Perth's property prices. Demand for rental properties significantly exceeds supply, leading to low vacancy rates — currently at 0.6%, the lowest in 42 years.

This scarcity is pushing property prices up and increasing rental income for landlords. With 80% of Western Australia’s population residing in the Perth/Bunbury region, the demand for housing in these areas is particularly acute.

This scarcity is pushing property prices up and increasing rental income for landlords. With 80% of Western Australia’s population residing in the Perth/Bunbury region, the demand for housing in these areas is particularly acute.

ECONOMIC RECOVERY AND RESOURCE SECTOR STRENGTH

MARKET CORRECTION AND INVESTOR SENTIMENT

Perth has been the strongest-performing capital city in terms of property price growth, with values rising more than 20% in the past year. However, this surge has led to concerns about sustainability.

Many investors are now entering the market driven by the fear of missing out on potential gains without adequate due diligence, often purchasing properties sight unseen due to fierce competition for available properties, further driving up prices. This rush can lead to overpaying for properties that may not yield long-term returns.

Comparing Melbourne: A Significant Upside Potential

Diverse Economic Base

Melbourne's economy is significantly more diverse, with robust sectors in finance, technology, education, and healthcare. This diversity provides stability, making it less susceptible to downturns compared to Perth's resource-dependent economy.

CURRENT MARKET CONDITIONS

- Low Vacancy Rates and High Demand

The rental market in Melbourne is experiencing ultra-low vacancy rates, which puts upward pressure on rents.

This dynamic creates a favorable environment for property investors, as high demand coupled with limited supply typically leads to increased rental yields and property values.

In contrast, while Perth has attractive rental yields, it has not shown the same level of sustained demand that Melbourne currently enjoys.

- Emerging Growth Market

Melbourne's market is seen as being at the beginning of a growth cycle, with many suburbs poised for significant capital appreciation. This timing is crucial for investors looking to capitalize on early growth cycles.

Investors in Melbourne have the opportunity to identify emerging suburbs that are currently undervalued but poised for growth.

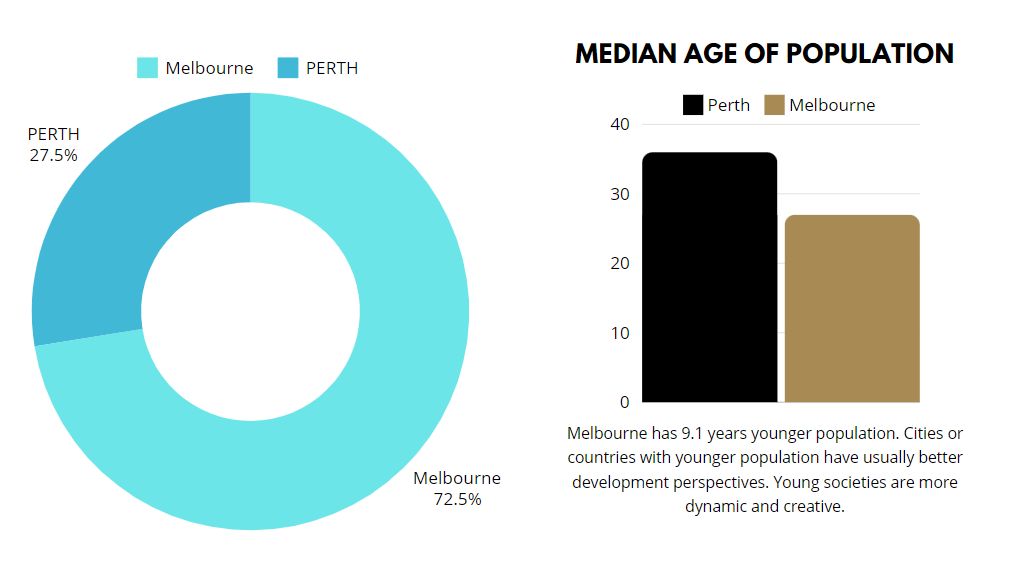

Population Growth and Urban Appeal

The city's appeal to young professionals, families, and international students ensures a steady demand for housing. Diverse demographics also mean a variety of property types are in demand, from apartments to family homes.

Perth, on the other hand, has experienced slower population growth. While still attractive, the growth is often concentrated in certain areas, leading to disparities in property performance across the city.

Investors need to be strategic about where they buy to ensure they are capitalizing on growth areas rather than falling into the trap of investing in oversaturated markets.

Perth doesn't quite match the vibrant, diverse demographic expansion seen in Melbourne.

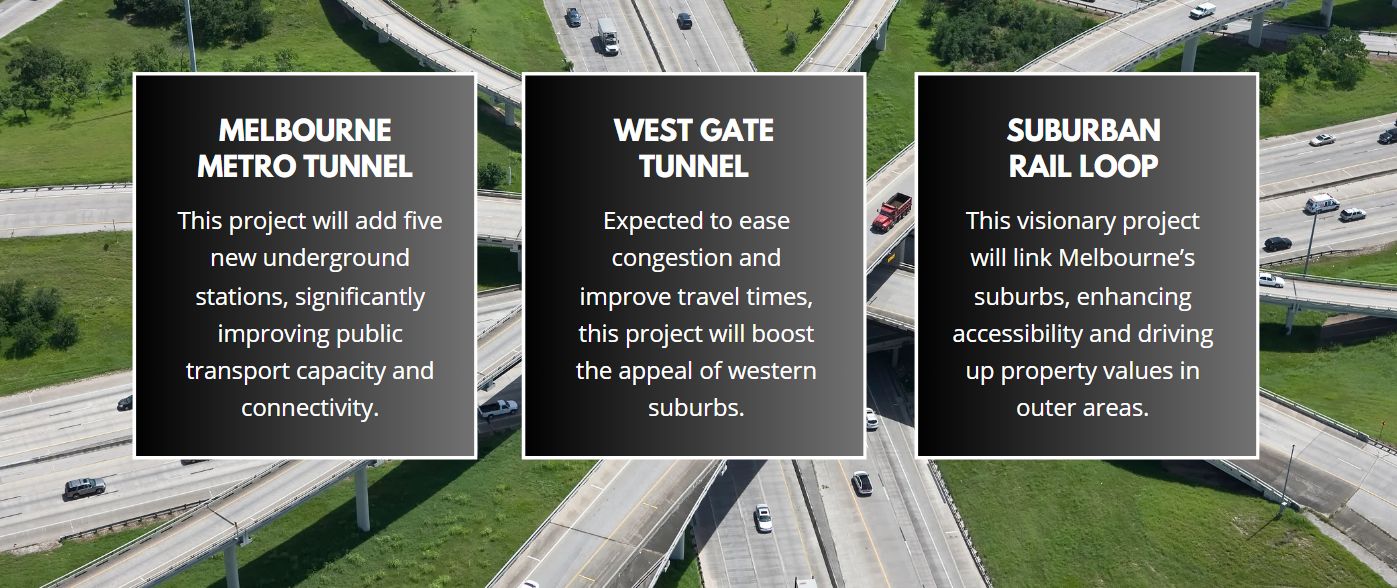

Building a Future: Infrastructure and Development

When it comes to property investment, infrastructure not only enhances the quality of life for residents but also significantly affects property values.

Melbourne’s infrastructure is second to none. Major projects like the Melbourne Metro Tunnel, the West Gate Tunnel, and the Suburban Rail Loop are transforming the city, making it more connected and accessible.

The Western Australian government has committed to significant infrastructure projects, particularly through the Metronet project that could bolster the economy and improve property values, however, the timing and execution of these projects can be unpredictable, adding another layer of risk for investors.

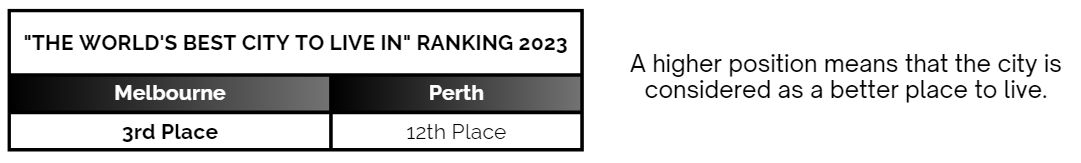

Quality of Life

Melbourne: Liveability at Its Best

Melbourne is consistently ranked as one of the world’s most liveable cities. It boasts a vibrant cultural scene, world-class education, top-notch healthcare, and diverse dining and entertainment options.

Tourism and Culture: A Vibrant Destination

- Melbourne is a large city with a vibrant cultural scene, known for its nightlife, arts, coffee culture, and historical architecture.

- From art galleries and theaters, the city hosts numerous events and festivals, attracting tourists and boosting the local economy.

- From the iconic Melbourne Cricket Ground to the bustling Queen Victoria Market, Melbourne is a tourist hotspot.

Tourism in Melbourne drives demand for short-term rentals and investment properties, offering excellent returns for investors.

Education and Healthcare: Top-Tier Services

- Melbourne's education and healthcare systems are world-class, making it a magnet for families and professionals alike.

- Home to some of the world’s best universities and schools like the University of Melbourne and Monash University, the city attracts students from around the world seeking quality education, creating demand for student accommodation.

- With renowned hospitals and medical research facilities, Melbourne offers exceptional healthcare services, contributing to its high liveability rating.

Perth, while having good education and healthcare facilities, doesn’t match the breadth and depth available in Melbourne. This disparity makes Melbourne more attractive to those prioritizing these services.

Perth: Natural Beauty and Lifestyle

- Perth is a smaller city that offers a laid-back lifestyle, surrounded by stunning natural beauty. It has a modern look, known for its beautiful parks and proximity to the Swan River.

- With its pristine beaches, parks, and outdoor activities, Perth is perfect for those who value a relaxed, healthy lifestyle.

- The city's livability is further enhanced by its high safety standards and quality healthcare and education systems.

Perth, though beautiful and with its own attractions, doesn’t have the same level of cultural and tourist appeal.

Quality of Living: Melbourne vs. Perth

Quality of living is a crucial factor that can significantly influence property values and rental demand. Let’s compare Melbourne and Perth across several key metrics, highlighting how these factors can add value to property investors.

Economic Indicators

| METRIC | MELBOURNE | PERTH | REMARKS |

| Gross domestic product (GDP) | $356.2B | $73.7B | Melbourne's GDP reflects a more diverse and robust economy, essential for sustained property value growth. This economic strength supports job creation and demand for housing. [Source: CIA World Factbook, 2024] |

| Unemployment Rate | 4.5% | 4.2% | Both cities have low unemployment rates, indicating good job opportunities. However, Melbourne’s diverse economy may provide more stability in job availability. [Source: City’s official stats, 2024] |

Environmental Considerations

| METRIC | MELBOURNE | PERTH | REMARKS |

| Weather | 15.1 °C- 20.7 °C (Oceanic) | 18.6 °C-25.2 °C (Mediterranean) | Melbourne's cooler climate can be appealing for those who prefer milder temperatures, potentially attracting a different demographic of renters and buyers. [Source: WMO, 2024] |

Transportation and Infrastructure

| METRIC | MELBOURNE | PERTH | REMARKS | ||

| Number of airports | 4 | 2 | Melbourne's four airports enhance its connectivity to international destinations, making it a more attractive location for global investors and expatriates. [Source: Wikipedia, 2024] | ||

| Cost of the monthly public transport ticket | $112.35 | $100.11 | While Melbourne's public transport is slightly more expensive, it offers a comprehensive network that facilitates easy commuting, which is a significant draw for residents and investors alike. [Source: City’s public transport website, 2024] |

Property Values and Rental Yields

UNIT AND HOUSE MEDIAN PRICES

| METRIC | MELBOURNE | PERTH | REMARKS |

| Median house price | $948,879 (2.0%MoM) | $757,399 (2.0%MoM) | Melbourne's higher property prices reflect its desirability and potential for long-term capital growth, despite recent fluctuations. |

| Median unit price | $610,102 (0.2%MoM) | $530,744 (2.2%MoM) | The unit market in Melbourne remains strong, with growth potential in emerging suburbs, making it an attractive option for investors seeking apartments. |

HOUSE RENTAL TRENDS

| METRIC | MELBOURNE | PERTH | REMARKS |

| Median weekly rent | $580/week | $650/week | Perth's higher weekly rent reflects strong demand, but Melbourne's rental growth is notable at 11.5% YoY. |

| Quarterly Change (QoQ) | 1.8% | 0.0% | Melbourne's slight increase indicates market adjustments, while Perth maintains stability. |

| Yearly Change (YoY) | 11.5% | 12.1% | Both cities show impressive annual growth, with Perth slightly ahead. |

UNIT RENTAL TRENDS

| METRIC | MELBOURNE | PERTH | REMARKS |

Median weekly rent for a unit | $550/week | $500/week | Both cities have similar rental prices for units, indicating a competitive market. |

| Quarterly Change (QoQ) | 0.0% | 0.0% | Stability in rental prices suggests a balanced demand and supply. |

| Yearly Change (YoY) | 10% | 14.6% | Perth shows stronger annual growth in unit rentals, reflecting heightened demand. |

UNIT AND HOUSE YIELD COMPARISON

Melbourne boasts a significantly higher unit yield of 6.9%, compared to Perth’s 0.9%. This stark contrast highlights Melbourne's attractiveness for investors focusing on apartments.

- A higher unit yield in Melbourne suggests that investors can expect better cash flow from their properties.

- Investors can benefit from consistent rental income, which is crucial for covering mortgage repayments and other expenses.

| CITY | UNIT YIELD (YoY) | QoQ | UNIT YIELD (YoY) | QoQ |

| Melbourne | 6.9% | 0.2% | 9.7% | 2.2% |

| Perth | 0.9% | 2.3% | 6.6% | 3.3% |

In terms of house yields, Melbourne again leads with a yield of 9.7%, while Perth offers a yield of 6.6%.

The higher house yield in Melbourne indicates strong rental demand and the potential for capital growth. This can be particularly advantageous for investors looking to build equity over time.

Capitalize on Opportunity: Invest in Melbourne Before Prices Soar!

While some may view Melbourne’s recent market stabilization as a concern, I see it as a strategic opportunity for forward-thinking investors.

The current market conditions in Melbourne, characterized by an increase in buyer activity, suggest that prices are set to rise soon. This is an opportune moment to enter the market before significant appreciation occurs, allowing investors to secure properties at lower price points.

While Perth may seem appealing due to its own set of attractive features, current rental yields, and lower entry prices, Melbourne's strong economic fundamentals, low vacancy rates, and emerging growth trends position it as the ultimate choice for property investment.

By choosing Melbourne, you position yourself to take advantage of a market that is on the brink of significant growth, making it a strategic choice for both new and seasoned investors alike.

Don't miss out on this opportunity – contact us now to discuss how you can capitalize on Melbourne's promising property market!

Perth's Recent Rise