More Options, Lower Prices – Why Aren’t You Investing in Melbourne?

01-Jan-2025

When is the best time to invest? When prices are high or at their lowest?

Melbourne prices are down, listings are up, and opportunities are everywhere. This is a notable shift towards a buyer's advantage. So, let me ask you directly:

Why aren’t you seizing this moment? Why miss the chance to own in one of the world's most livable cities at an affordable price? This is a rare opportunity that could change your financial future.

The State of Melbourne’s Property Market in 2025

Current Market Overview

Quantitative Insights

Listings Surge: There has been a 9.5% increase in property listings year-on-year, marking the highest level of available properties since 2012. This surge provides buyers with a wider selection than in over a decade.

Rental Market Dynamics: Despite the drop in property prices, the rental market remains robust, with rental rates climbing over 9% for both houses and units within the past year.

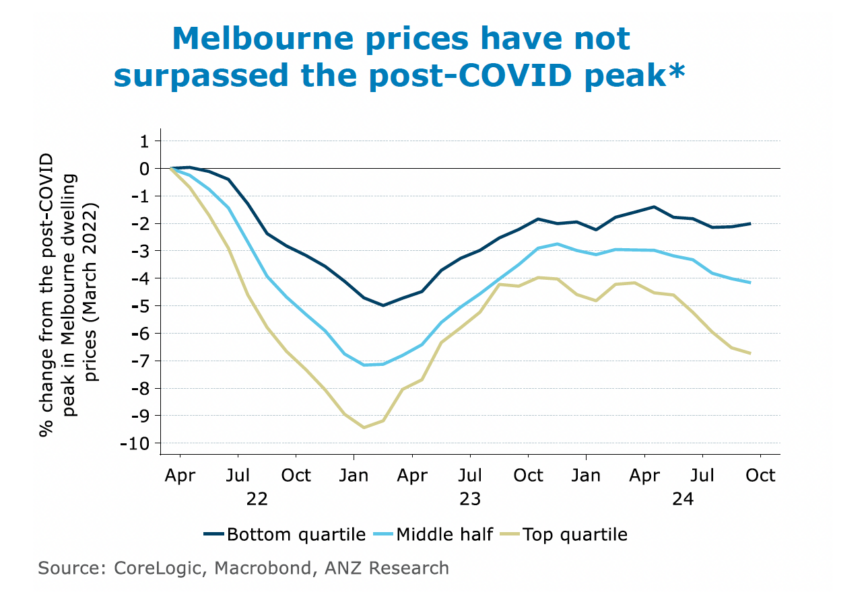

Historical price drops from the peak in March 2022 to January 2023.

From March 2022 to January 2023, Melbourne's home prices fell by 7.9%. This was a correction after the boom in 2020 and 2021, when prices increased by 15.8%.

- - Melbourne's property market has been resilient over the past 40 years.

- - The decline in Melbourne was smaller than Sydney's decline, which was 6.94% from February 2022 to November 2022.

- - Melbourne's recovery has been less sharp than other capital cities.

- - Melbourne's housing market has not performed as well as other capitals in the past year or two.

Projected price trends for the next 12 months based on current market dynamics.

In 2025, Melbourne's property market is projected to experience a notable rebound, driven by various factors influencing both demand and supply. Here’s an overview of the anticipated price trends for the next 12 months based on current market dynamics.

1. Price Increase Estimates: Recent forecasts suggest that Melbourne's median house prices could rise by approximately 3% to 6% over the next year.

This translates to an increase of about AUD 27,630 to AUD 55,260 for the current median price of AUD 921,0001. For units, a rise of AUD 18,500 to AUD 37,020 is expected, reflecting a similar upward trend in the unit market.

2. Long-Term Outlook: According to Oxford Economics Australia, Melbourne's median house price is anticipated to reach around AUD 1.157 million by mid-2026, marking a substantial increase from the current levels.

This growth is expected to be fueled by a resurgence in migration and economic recovery following recent downturns.

3. Market Recovery Factors: The expected price recovery is attributed to factors such as:

- Population Growth: An increase in both interstate and overseas migration is likely to bolster housing demand. Melbourne's population is anticipated to reach 8 million by 2050, driving demand for housing.

- Economic Stability: As confidence returns among buyers and sellers, auction clearance rates are showing strength, indicating a depth of buyers in the market.

- Government Initiatives: Potential government assistance programs aimed at first-time buyers may enhance market participation and affordability.

Investment Opportunities

Despite recent challenges, there are significant opportunities for investors in Melbourne's property market:

Undervalued Properties: Currently, many properties are priced below replacement costs, presenting unique buying opportunities.

Family-Friendly Homes: Demand remains strong for spacious homes in established suburbs, particularly those with good access to amenities and schools.

While Melbourne presents incredible opportunities, potential investors must navigate a landscape marked by both short-term risks and long-term benefits.

Acknowledging Short-Term Risks

Yes, new taxes and stricter rental laws may pose immediate concerns. Land taxes have risen by 5%, which can impact cash flow for property owners. Furthermore, recent reforms in tenancy laws have shifted the balance in favor of tenants, complicating property management for landlords. These changes can create apprehension among potential investors, especially those focused on short-term gains.

Long-Term Benefits

However, it is crucial to counterbalance these risks with the long-term capital growth potential that Melbourne offers.

Historically, property values in Melbourne have shown resilience and a tendency to recover from downturns.

For example, despite the recent fluctuations, Melbourne's property values have increased by 10.6% since the onset of COVID-19 in March 2020, although they remain 4.4% below their peak in March 2022. This historical trend suggests that while short-term challenges exist, the long-term outlook remains promising.

Investors who can think beyond immediate dips may find that the long-term capital growth potential continues to make Melbourne a lucrative investment destination. With ongoing population growth and infrastructure developments expected to drive demand, properties in well-located suburbs are likely to appreciate over time.

| For Rental Investors: Melbourne is home to over 500,000 international students in need of accommodation, creating a steady stream of tenants for rental properties. This demand ensures that rental yields remain attractive, even amidst regulatory changes. For Long-Term Investors: While recent government policies, such as increased land taxes and stricter tenancy laws, may introduce short-term challenges, they do not overshadow Melbourne’s long-term capital growth potential. |

Is Your Budget Ready?

For example, in Melbourne’s CBD, you can now buy a 2-bedroom apartment for as low as $600,000, down from $650,000 last year. This presents a unique opportunity to invest in a prime location at a more accessible price point.

- For $600,000: A 1-2-bedroom apartment in Melbourne's CBD offers modern amenities and proximity to public transport.

| Year | Projected Median Property Price | Expected Increase from Current Prices |

| 2025 | $650,000 | +$30,000 |

| 2026 | $700,000 | +$50,000 |

| 2027 | $750,000 | +$100,000 |

That’s where I come in. I'm here to guide you through every step, ensuring your investment journey is seamless and profitable.