Singapore vs Melbourne: Where Should You Invest Next?

Josh Tay

Last Updated on 08-Aug-2025

Have you heard the story of a seasoned Singaporean couple, both experienced real estate agents, who were swindled into buying 16 overseas properties in two fraudulent projects?

How did they fall victim to such deception, and what lessons can we draw from their experience?

There’s also another real life story about a young professional in Singapore who bypassed the traditional path of local property ownership. Instead, she ventured into international real estate, seizing opportunities that offered financial flexibility and broader investment horizons.

What drove her to take this unconventional route, and how did it lead to financial freedom?

And when it comes to choosing the perfect location for your next venture, between Melbourne vs. Singapore, which one is the better investment?

In this article, we'll delve into the real-life experiences of these two very different property investment journeys, and delve into an in-depth comparison, examining every angle that impacts and guides your own property investment decisions.

Why Compare Melbourne and Singapore?

When it comes to property investment, few cities can compete with the allure of Melbourne and Singapore. You might be wondering which city offers better returns, fewer risks, and more growth potential.

Both Melbourne and Singapore are renowned for their economic stability, robust real estate markets, and high quality of life. However, they cater to different types of investors and offer unique advantages. Understanding these differences can significantly influence your investment strategy, ensuring that you make an informed decision that aligns with your financial goals.

The Economic Landscape of Two Cities

Singapore: The Asian Powerhouse

Singapore's economy is a marvel of modern development. Known for its financial hub status, strong legal framework, and pro-business environment, Singapore attracts investors worldwide. The city-state's GDP growth has been resilient, and its strategic location in Southeast Asia makes it a gateway for trade and commerce.

Melbourne: The Australian Gem

Melbourne, on the other hand, is Australia's cultural and economic powerhouse. With a diverse economy spanning finance, technology, education, and tourism, Melbourne offers a stable and growing market. Australia's property market, particularly in Melbourne, has shown remarkable resilience, bouncing back stronger post-pandemic and continuing to offer attractive returns.

Property Market Dynamics

| Singapore's Property Market | Melbourne's Property Market |

| Singapore's property market is characterized by high demand and limited supply. The government imposes strict regulations to curb speculative buying and maintain affordability. Additional Buyer’s Stamp Duty (ABSD), especially for foreign buyers and Singaporeans purchasing second properties, can be a significant financial burden. Despite these measures, property prices remain high due to limited land availability and constant demand. | Melbourne presents a different scenario. The city offers a more relaxed regulatory environment, a broader range of property types, and relatively lower prices. Melbourne's property market is driven by strong population growth, international migration, and a steady influx of students and professionals. The variety of investment opportunities, from high-rise apartments in the CBD to suburban houses, caters to diverse investor preferences. |

Lower Investment Outlay

Case Study: Owning an $800,000 Property in Melbourne vs. Singapore

The table below compares upfront payments for new builds in Melbourne versus resale properties in Singapore, demonstrating that investing in Melbourne can save you a substantial amount of money in property taxes if you consider ABSD. This allows you to maximize your returns and grow your wealth more effectively.

| Cost Item | Melbourne, Australia | Singapore |

| Property Purchase Price | $800,000 | $800,000 |

| Down Payment (25% of purchase price) | $200,000 (25%) | $200,000 (25%) |

| Loan Amount (75% LTV) | $600,000 | $600,000 |

| Loan Term (subject to TDSR) | 30 years | 30 years |

| Interest Rate | 4% | 3% |

| Estimated Monthly Repayment | $2,864 | $2,530 |

| Option Fee / Deposit | $80,000 (10% need to settle in 3weeks) | $8,000 (1% of the property value) |

| Exercise Fee | Not Applicable | $32,000 (4% of the property value) |

| Stamp Duty | $44,000 (5.5%) | $18,600 (2.325%) |

| Cash / CPF component | Cash upon settlement $120,000 (15% of property value) | Cash / CPF $160,000 (20% of property value) |

| Additional Buyer's Stamp Duty (ABSD) | Not Applicable | $160,000 (20% of purchase price) |

| Foreign Purchaser Additional Duty (FPAD) | $64,000 (8% of purchase price) | Not Applicable |

| Property Tax | $1,200 - $3,000 per year | $2,400 - $6,000 per year |

| Valuation fee | $200 | $163 to $700 for private properties |

Legal Fees and Conveyancing Fees | $800 - $2,500 | $2,000 - $3,500 |

| Mortgage Registration Fee | $119 | $100 |

| Maintenance Fee, Including Fire Insurance and Building and pest inspection) | $2,000 to $4,000 per annum | $330 to $1,150 annually |

| Total Upfront Costs (excl. down payment) | $188,800 - $190,500 | $220,600-$222,100 + 20% ABSD ($160,000) |

In Singapore, the total upfront costs for a first-time buyer range from $220,600 to $222,100.

- Singapore requires the full 25% down payment upfront.

- An additional 20% ABSD ($160,000) if it's your second property. This makes the total upfront cost significantly higher.

In contrast, Melbourne 15% down payment is payable upon settlement or completion, which provides greater financial flexibility.

For an $800,000 budget in Singapore,

- Options are limited to either a studio or a one-bedroom resale property, typically not in prime locations.

- These properties often do not appreciate significantly, making them less attractive as investments.

- New launch properties are generally out of reach within this budget.

In Melbourne, the same budget can secure better property options with higher rental yields. This combination of lower upfront costs, flexible payment terms, and better investment prospects makes Melbourne a more appealing choice for property investors looking to maximize returns and grow their wealth effectively.

While the upfront cost difference between Melbourne and Singapore may not seem significant at first glance, Melbourne's lower property taxes and higher rental yields make it a more financially prudent investment choice.

Favorable Tax System for Foreign Investors

Affordable Property Prices

Another key factor that makes Melbourne an attractive investment destination is its relatively affordable property prices compared to Singapore. While the city-state has seen its median private home prices soar to a staggering US$1,200,000 (~S$1,610,300), making it the most expensive in the Asia-Pacific region, Melbourne offers a more accessible entry point for investors.

This affordability not only makes it easier for first-time investors to get a foot in the door, but it also allows seasoned investors to diversify their portfolios with multiple properties in Melbourne. With lower upfront investments, you can stretch your investment dollars further and potentially generate higher returns over time.

Potential for Capital Growth

But it's not just about the lower investments – Melbourne also offers significant potential for capital growth. According to the QBE 2022-2025 Housing Market Outlook report, Melbourne's property prices are expected to rise by approximately 10% over the next three years. This growth potential is fueled by a combination of factors, including strong population growth, a thriving economy, and ongoing infrastructure investments.

As more people flock to Melbourne for its world-class education, job opportunities, and enviable lifestyle, demand for housing will continue to rise, driving up property values and generating substantial returns for savvy investors.

Higher Rental Yields

In addition to capital growth, Melbourne also boasts higher rental yields compared to Singapore. The gross rental yield for houses in Melbourne stands at 4.1%, while the gross rental yield for units is an impressive 6.7%. In contrast, the average gross rental yields in Singapore are lower, at 4.63% (Q1, 2024).

This means that as a property investor in Melbourne, you can expect to generate a higher income stream from your rental properties, providing you with a steady source of passive income and potentially higher returns on your investment.

Quality of Life: Beyond Numbers

Cost of Living: Balancing Your Budget

| Food | Melbourne is 9% Higher than Singapore. |

| Housing | Melbourne is 24% Lower than Singapore |

| Clothes | Melbourne is 18% Higher than Singapore |

| Transportation | Melbourne is 14% Lower than Singapore |

| Personal Care | Melbourne is 3% Lower than Singapore |

| Entertainment | Melbourne is 11% Higher than Singapore |

*These prices were last updated on April 11, 2024. Exchange rate: 0.890 SGD / AUD.

*This comparison is based on abundant and consistent data. It is based on 1,050 prices entered by 181 different people.

| Acknowledge that living costs can vary depending on lifestyle choices. These figures are estimates, and we encourage you to research specific neighborhoods and desired living arrangements for a more precise picture. |

Education and Lifestyle: A Magnet for International Students

Singapore's Education Hub

Singapore is a global education hub, attracting students from around the world. Its universities are highly ranked, and the city offers a safe and conducive environment for learning. However, the competition for school placements can be intense, and the cost of education is high.

Melbourne's Educational Excellence

Melbourne is home to some of Australia's top universities, including the University of Melbourne and Monash University. The city's reputation for high-quality education and a multicultural environment makes it a preferred destination for international students. The more affordable living costs and vibrant student life add to its appeal.

The Risks and Rewards of Investing Abroad

Two Singaporean Real Stories That Will Change Your Perspective

In 2012, a Singaporean couple, both experienced real estate agents, were duped into buying 16 properties in two overseas projects for around $800,000 total. They were misled by other agents in Singapore who oversold the projects and provided false information, making the deals seem like lucrative investments. In reality, both overseas projects turned out to be scams - the developers did not even own the land or have proper permits. The couple sued the agents and developers in both cases and eventually won their money back, but only after a long legal battle lasting over a decade. |

*Source: Straits Times

The key lessons here are profound. Be very cautious when investing in overseas real estate, especially if you are unfamiliar with the market and developer.

Never buy an overseas property just because it is cheap - you need to thoroughly research the market and developer first.

On the other side of the spectrum, we have Melody, a young Singaporean professional who decided to purchase property overseas instead of in Singapore. Melody didn't want to wait until she was 35 to own property, a common situation in Singapore. She wanted the ability to own multiple properties, which is limited in Singapore due to restrictions, and preferred freehold properties over Singapore's 99-year leaseholds, which depreciate over time. While property in Europe may be more affordable in terms of purchase price, the higher mortgage interest rates make it slightly more expensive per month compared to Singapore. However, Melody was willing to take this "small gamble" to have more control over her finances and living situation at a younger age. She started by purchasing a modest studio apartment overseas as a "starter home" to gain experience as a foreign property owner. |

*Source: Stacked Homes

This story highlights a key theme: the desire for more flexibility, control, and personal fulfillment in property ownership, even if it means taking on some additional financial risk compared to the typical Singaporean approach.

Current Price, Demand, and Supply Index: Melbourne vs. Singapore

Melbourne Property Market Outlook for 2024

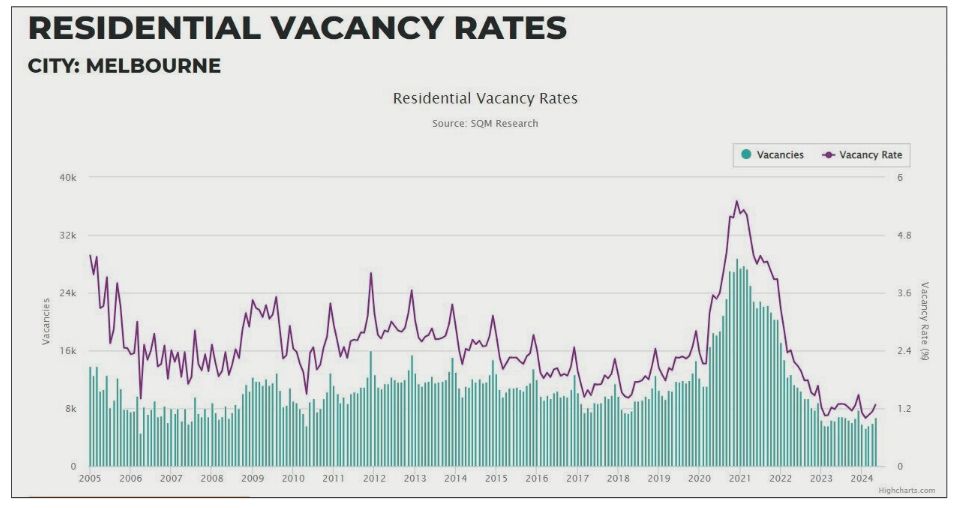

Melbourne's property market has underperformed compared to other capital cities over the past year, but values are expected to gain ground in 2024 as confidence returns to buyers and sellers.

- Certain Melbourne suburbs have seen strong price growth, with over 50 suburbs exceeding the national average house price growth in 2023. For example, suburbs like Toorak, Canterbury, and Balwyn saw house prices rise by over $100,000 more than the average Australian wage.

- Despite this underperformance, Melbourne's rental market remains extremely tight, with a vacancy rate of just 1.5% compared to the balanced market rate of 2-2.5%. This tightness is driven by strong population growth and a lack of new housing supply.

- As Melbourne's population is projected to reach 8 million by 2050, requiring 1.5 million more dwellings, this growth will support property prices but also strain infrastructure.

Singapore Property Market Situation

In contrast, Singapore's rental market has softened recently. The high property prices and the Additional Buyer’s Stamp Duty (ABSD) have cooled the market, impacting demand and rental yields.

Why Buy in Melbourne Now?

For strategic investors, Melbourne presents an opportune market to buy into. The current underperformance offers a chance to find good value properties with upside potential. While location, property type, and suburb selection are crucial, the overall market conditions favor long-term growth.

If you're in your 30s, time is your best friend. Investing in Melbourne now allows you to leverage the city's projected growth over the next few decades. By buying and holding, you can benefit from both rental income and capital appreciation, setting yourself up for a prosperous future.

The Importance of Due Diligence: My Approach as Your Realtor

The stories I shared emphasize a crucial point: not all investments are successful, and there is always risk involved. Even the most knowledgeable investors can fall prey to scams if proper due diligence is not conducted.

This is why, as a realtor with 18 years of experience, I prioritize due diligence above all else.

I make it a point to personally visit the developers and see their projects first-hand to ensure they are legitimate.

This practice is not just for the benefit of my clients but also to maintain my own credibility and reputation. I want to avoid any future problems that could arise from working with unreliable developers.

My primary goal is to safeguard my clients' investments and provide them with opportunities that will truly benefit them.

Ready to Take the Next Step in Property Investment?

Let's Connect Today!

So, between Melbourne and Singapore, Which one is Your Best Bet?

Ultimately, the choice between investing in Melbourne or Singapore comes down to your personal goals, risk tolerance, and investment strategy. If affordability and higher rental yields are your top priorities, Melbourne may be the better choice.

However, if you're looking for a stable market with strong growth potential and a unique lifestyle experience, Singapore could be the way to go.

Regardless of which city you choose, it's crucial to do your research, work with reputable professionals, and have a clear investment strategy in place.

Don't wait any longer to take advantage of these opportunities.

Contact us now!