Sydney Soars, Brisbane Booms. What about Melbourne? Insights for Singaporean Investors

Josh Tay

Last Updated on 08-Aug-2025

I've witnessed the incredible rise of Sydney and Brisbane's markets. But you might be wondering – what about Melbourne? The once undisputed property king seems to be simmering while others boil. Don't worry, I'm here to shed some light and help you decide if Melbourne holds the key to your Australian dream.

Melbourne: The Sleeping Giant?

Let's be honest, Melbourne hasn't been experiencing the same rapid growth as Sydney or Brisbane. But here's the thing: Melbourne's property market has a history of stability, making it a reliable long-term investment.

Remember the crazy lockdowns? While they might have put a limit on short-term gains, they also prevented the market from overheating – a blessing in disguise for the long haul.

So, what's behind Melbourne's current state?

In the recent lockdowns, Melbourne's international student population took a hit. This group traditionally fuels the rental market, especially in inner-city apartments.

However, the tide is turning! Universities are reporting a surge in international student applications, and with borders reopening, Melbourne's vibrant student life is poised for a comeback.

| Melbourne is consistently ranked as one of the world's most livable cities for students – a renter's dream! |

Beyond Students: Demographics and Infrastructure and Rental Yields

Now, let's delve deeper. Melbourne boasts a young, educated population – a magnet for businesses and a surefire sign of future growth.

Just look at the massive infrastructure projects underway, like the Melbourne Airport Rail Link and the Suburban Rail Loop – these will unlock new pockets of opportunity and enhance connectivity.

Infrastructure Projects in Melbourne

North East Link

- $15.8 billion project, Victoria's largest road project ever

- Will create over 10,000 jobs and take 15,000 trucks off local roads

- Expected to slash travel times for motorists between Melbourne's north and south-east by up to 30 minutes

- Includes over 25km of new walking and cycling paths and Melbourne's first dedicated busway along the Eastern Freeway

- Expected to provide a $427 million annual economic boost once completed

Metro Tunnel

- $11 billion rail project creating nearly 7,000 jobs

- Twin 9km tunnels running from South Kensington to South Yarra

- 5 new underground stations: North Melbourne, Parkville, State Library, Town Hall, Anzac

- Will enable over 500,000 extra passengers to use Melbourne's rail network during peak periods each week

- Commuters could save up to 50 minutes per day

West Gate Tunnel

- $6.8 billion road project providing a second freeway link between the west and the city

- $6.8 billion road project providing a second freeway link between the west and the city

- Will include twin tunnels, a second river crossing, and 4 new lanes on the West Gate Freeway

- Expected to take 9,000 trucks off local streets in the inner west

- 9 hectares of new parks and wetlands, plus 14km of new walking and cycling paths

M80 Ring Road Upgrade

- $1 billion project upgrading the M80 Ring Road between Sydney Road and Edgars Road

- Will increase capacity, improve safety and create more reliable travel times for the 165,000 motorists who use this road daily

Melbourne Airport Rail Link

- $8-13 billion project connecting the CBD to the airport via rail Trains expected to run every 10 minutes - Passenger numbers at Melbourne Airport projected to almost double to 67 million by 2038

Other major projects include the $2 billion Melbourne Intermodal Terminal in the Docklands, $1.5 billion investment in new rolling stock, and infrastructure to support the rollout of Next Generation Trams starting in 2025.

These transformative infrastructure projects will enhance connectivity, reduce congestion, create jobs, and support Melbourne's continued growth as Australia's fastest growing city.

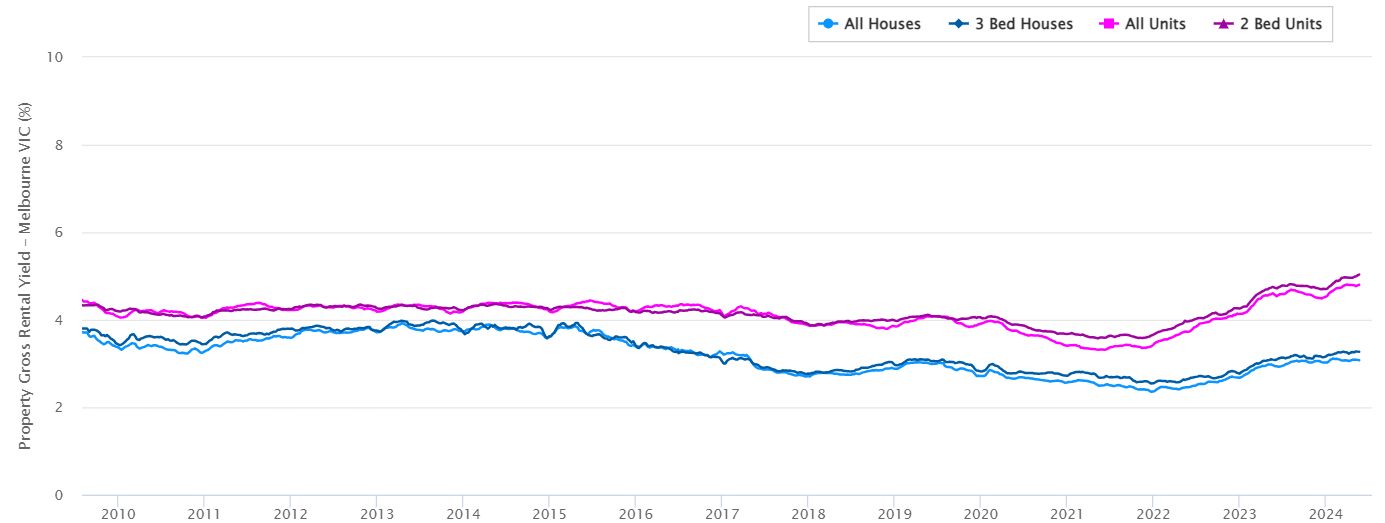

The Numbers Don't Lie: Rental Yields Beckon

Here's where it gets interesting for investors: rental yields in Melbourne are consistently higher than Sydney and Brisbane. This means you can expect a healthier return on your investment.

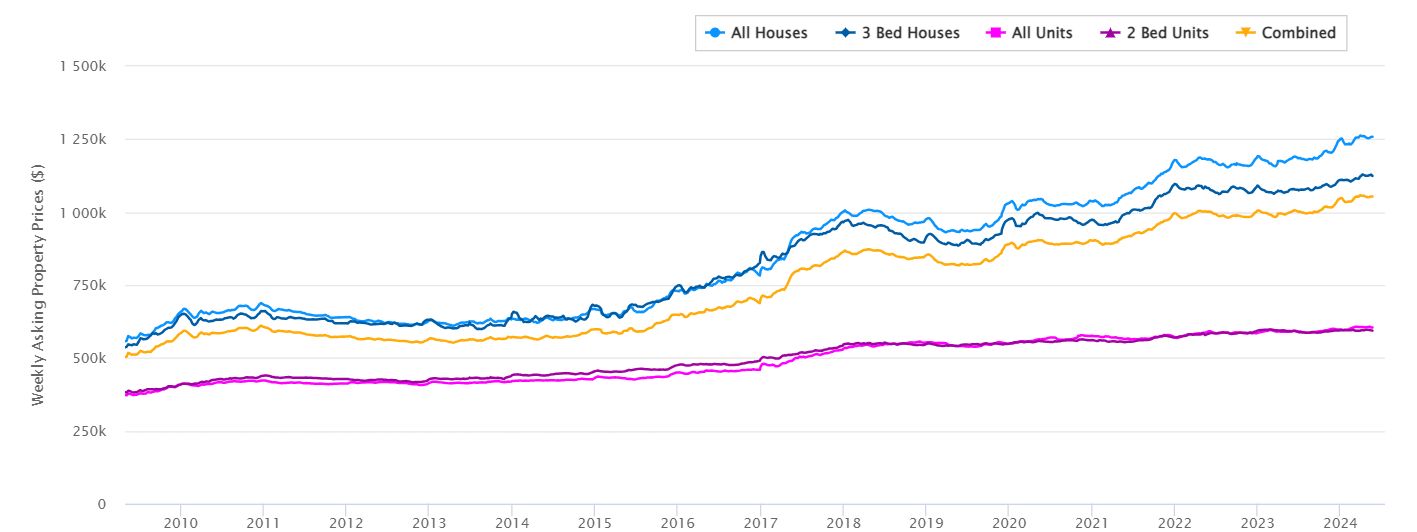

Weekly Asking Property Prices

The Melbourne Market: A Rental Crisis Meets Investment Opportunity

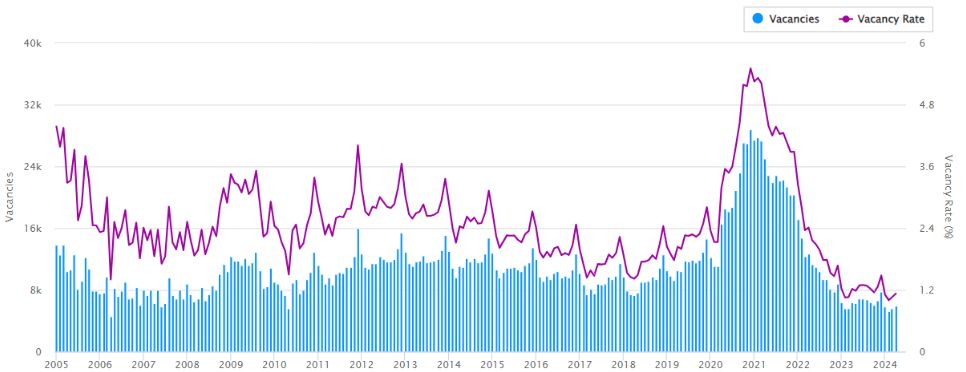

Speaking of rentals, Melbourne is facing a full-blown crisis. Vacancy rates are at rock bottom, with high demand and limited supply putting upward pressure on rents.

This is music to the ears of investors! Strong rental yields, coupled with potential for future capital growth, make Melbourne an incredibly compelling proposition.

Residential Vacancy Rates

Houses vs Apartments, Inner-City vs Suburbs: Where to Invest in Melbourne?

Now, let's talk specifics.

Houses tend to outperform apartments in terms of capital growth, but apartments offer better rental yields and lower maintenance costs.

When it comes to location, inner-city areas are always in demand, but don't underestimate the potential of well-connected suburbs. The shift to remote work might see a rise in popularity for suburbs with good amenities and easy access to green spaces.

Click here to explore options.

The Melbourne Opportunity: A Strategic Investment

Look, Melbourne might not be experiencing the dizzying growth of other cities right now, but that's exactly what makes it so intriguing. It's a stable market with strong fundamentals, primed for a resurgence.

With the right guidance, you can snag a property at a good entry point and reap the rewards of future growth and consistent rental income.

Ready to Enter into Melbourne's Market?

As your trusted realtor, I'll help you navigate the market and find the perfect property to build your Australian dream on. Let's unlock Melbourne's hidden potential together!

Contact us now!