Tenants Are Fighting for Space: Melbourne’s Undersupplied Suburbs vs. Stabilizing CBD

Josh Tay

Last Updated on 08-Aug-2025

If you’ve been watching Melbourne’s property market, you can already sense it, demand is heating up. Tenants are fighting for space, and the numbers prove it. Vacancy sits at just 1.8% in July 2025 (a bit higher than the national 1.2%, but still very tight). Rents keep rising too, +3.8% year-on-year overall, with houses climbing +4.1% and units up +3.3%.

Behind these numbers are families searching for stability, students needing a place close to campus, and professionals competing for fewer homes than the city can offer.

Suburbs are badly undersupplied. Even the CBD, which once had too many apartments, is now filling up again.

So what does this mean for you as an investor? It means low vacancy, strong rent, and a very rare chance to buy before prices move up again.

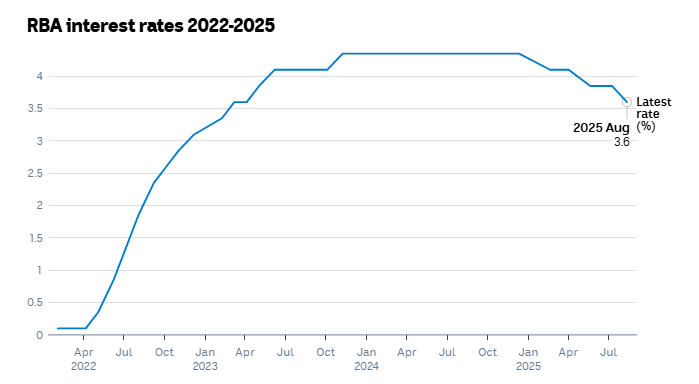

Australia's Reserve Bank Has Cut Rates Three Times This Year

At the start of 2025, interest rates in Australia were above 4.3%. Since then, the Reserve Bank of Australia has cut rates three times. The latest cut came this August, and now the base rate is 3.6%.

For you, this means:

- Local buyers can now borrow at around 4.5%.

- Foreign buyers (including Singaporeans) at around 5.5%.

Just months ago, foreigners were paying closer to 6.5%. That is a big saving, and it makes Melbourne property far more attractive.

Here’s my honest take: every cut makes Melbourne more affordable, but it also brings more buyers back. If you wait, you may find yourself paying more later.

Why Tenants Are Struggling

The numbers tell the story:

- In the suburbs, vacancy is below 1%. That means almost every property gets rented quickly.

- In the CBD, vacancy has dropped to around 2.5%, the lowest since 2019.

If you visit an open house, you’ll see 15–20 groups of tenants competing for one unit. Families are moving further out, students are back, and young professionals want to stay near the city.

For investors, this means:

✔️ Rents are rising

✔️ Units don’t sit empty

✔️ Your return is stronger and more secure

Suburbs or CBD: Where Is the Smarter Bet?

Both suburbs and the CBD are good, but they work in different ways:

Melbourne Rental Yield Comparison (Aug 2025)

| Location | Rental Yield Range (%) | Vacancy Rate (%) | Investor Note |

| CBD (Southbank, Docklands, La Trobe St) | 4.5 - 5.2 | 2.5 | High demand from students & young workers, improving yields |

| Inner Suburbs (South Melbourne, St Kilda Rd, West Melbourne) | 4.0 - 4.8 | 2.0 | Prestige and lifestyle appeal, steady capital growth |

| Middle-Ring Suburbs (Reservoir, Blackburn, Greensborough) | 3.8 - 4.5 | 1.0 | Family-friendly areas, low supply, stable tenants |

| Outer Growth Corridors (Kalkallo, Mickleham, Rowville) | 4.8 - 5.6 | 0.8 | Strong rent growth, perfect for long-term hold |

I know you’re wondering: Okay, but what’s on the table?

| Project | Location | Type | Price (AUD) | Why It matters | |

| R. Iconic Townhouse – Final Release | South Melbourne | 3BR, 2Bath | $2,562,750 | Rare townhouse living minutes from CBD. Final release = scarcity play. | |

| 188-192 Grimshaw St | Greensborough | 1BR | $687,900 | Entry-level Melbourne property. Vacancy almost zero in this pocket. | |

| Stud Park Residence | Rowville | 2BR | $716,000 | Family-friendly location, perfect for tenants priced out of CBD. | |

| Cloverton Estate | Kalkallo | 3BR House | $549,000 | Entry-level house & land. Growth corridor. | |

| The Albertine by Mirvac | Queens Lane | 2BR, 2 Bath | $1,630,000 | Prestigious location, Mirvac brand trust. | |

| Aspire Melbourne | CBD (King St) | 1BR + Study | $612,500 | Stylish, central, high rental yield. | |

| The Carter Building | St. Kilda Road | 3BR Penthouse | $4,565,000 | Blue-chip luxury play. For investors who want trophy assets. | |

| Botanical Apartments | Mickleham | Family Apartment | $557,900 | Growth suburb with long-term rental demand. | |

| La Vue Sinagra | Sinagra | 3 +1BR House | $800,170 | Suburb Play |

(Click for full listings and property projects)

My observation as your realtor: Melbourne’s inner-city units (La Trobe, Southbank, Docklands) are priced at levels still below their historical highs. That gives you built-in upside once migration numbers keep climbing. Suburbs are already stretched, if you wait, your entry price will be higher.

Why Global Investors (Especially Singaporeans) Love Melbourne Properties

Singaporeans have always had a soft spot for Melbourne.With rates easing, currency advantage, and Melbourne still undervalued compared to Sydney, the capital flow is shifting.

- Melbourne’s median apartment price: $640,000.

- Sydney’s: $825,000.

- Perth’s: $560,000, but with less depth of international demand.

The gap means Melbourne offers both affordability and global liquidity.

Sydney is too expensive for many, Perth has less global demand, but Melbourne sits in the sweet spot, affordable, high demand, and always liquid when you need to sell.

Add to that:

- World-class universities

- Multicultural lifestyle

- Strong retirement appeal

And you see why Singaporeans always come back to Melbourne.

Right now, you are standing at a rare point in time:

- Rates are down.

- Rents are strong.

- Melbourne is still undervalued.

- Stock is limited.

Investors who act now will lock in the best prices and properties. Those who wait will be left paying more or worse, unable to buy at all.

I can guide you get to the right property.

Connect with me now!