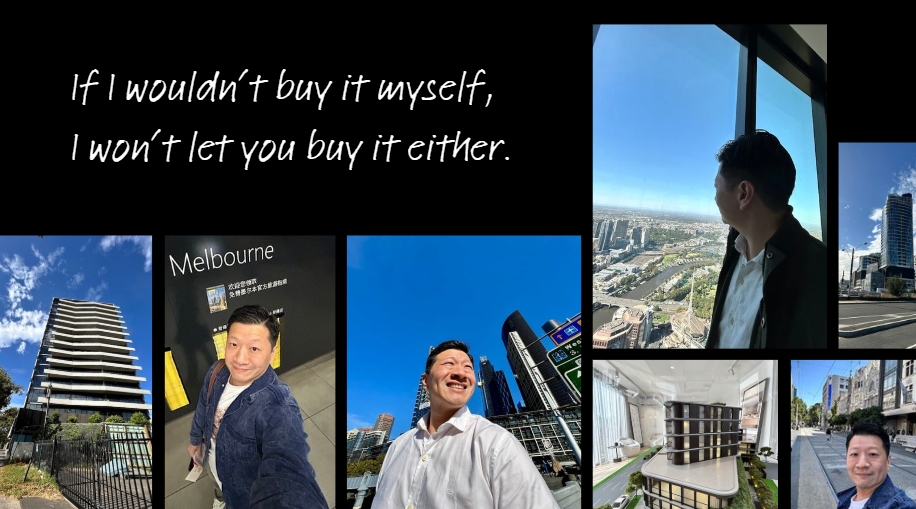

The Worst Melbourne Properties I Would Never Buy

Josh Tay

Last Updated on 08-Aug-2025

I love Melbourne. It’s one of the world’s most liveable cities, and for many of my clients, it represents an opportunity to invest, to live, to study, or to retire, but you need to be careful. because not all Melbourne properties are worth your money.

In fact, some of them? I wouldn’t buy them even if you gave me a discount.

Now, I won’t name and shame a specific developer, but you deserve to avoid these costly mistakes. I've created a private “Do Not Buy” list that I share only with serious investors who want to know which projects to avoid and why.

You’ll find the link below to request it. But before we go there, let me show you the 6 red flags you should never ignore.

Red Flag #1: Melbourne CBD Is Flooded With Empty Units

Did you know some parts of Docklands and Southbank still have vacancy rates above 7%?

As of today, thousands of apartments remain unsold or unrented. Developers are flooding the market, and tenants have endless choices. That means

- Lower-than-promised rental yields

- Long vacancies (sometimes 2–4 months), competing with hundreds of similar listings

- You may need to offer discounts or freebies to attract tenants.

Think rental income is guaranteed in the CBD? Think again. You might end up subsidizing your tenant just to keep the lights on.

Red Flag #2: The Layouts Are… Honestly, Unlivable

You can’t imagine how many times I’ve walked into show units and thought: “Who designed this?”

– Bedrooms with no windows

– No dining space

– Kitchens smaller than a hotel minibar

– Balconies, you can’t even sit on

It might look fine in a brochure, but try living in it. Or better yet, try renting it out. Tenants have options, and they’ll skip your unit for something that feels like home.

Red Flag #3: Unknown Developers, No Track Record

Some of these “up-and-coming” developers haven’t completed a single project.

And guess what? Overseas buyers (especially from Singapore and Asia) are often the target market because we don’t live there to do proper checks.

Would you hand over $600,000 or more to someone you’ve never met, for a product you’ve never seen, from a brand that doesn’t exist on Google? Neither would I.

Red Flag #4: The 5% “Rental Guarantee” Is a Trick

This one hurts the most because it feels so reassuring until you learn how it works.

Here’s the trick: They inflate the selling price by $40K–$60K, then give you back a “guaranteed” rent from your own money for 2 years.

So for two years, you feel secure… but when that ends?

So after the 2 years? Market rent kicks in, and it’s usually 20–30% lower than the promise. Now you’re stuck with a unit that's overpriced and can’t break even. That’s not investing. That’s getting played.

Red Flag #5: Body Corp Fees That Burn Your Yield

Yes, infinity pools and rooftop lounges look cool. But most tenants don’t use them. Yet you still pay $5,000–$6,000 a year in body corporate (strata) fees.

That doesn’t include:

– Maintenance and cleaning fees between tenants

– Leasing agent fees

– Land tax

– Vacancy periods

When you run the numbers, these "investments" often yield less than 2% net or worse, end up negative.

Red Flag #6: Zero Exit Strategy

You know what’s terrifying? Trying to sell your unit in a 300-unit tower… when everyone else is also selling the same layout.

– Someone’s unit is $20K cheaper.

– Another one comes with free furniture.

– One guy throws in 6 months of rent-free leasing.

It’s a race to the bottom. And guess who loses? The investor who came in last, the one who believed the hype.

So… Which Projects Should You Avoid?

If you want to see which Melbourne projects I will never recommend and why,

Get the List Here

The list includes:

- CBD high-rises with poor rental history

- Towers built by developers with no proven record

- Student-style blocks that are hard to exit

- Properties with inflated prices and no future demand

One Wrong Buy Can Hold You Back for Years

Look, I’m not here to scare you. I’m here to protect you. So, if you’re serious about buying in Melbourne, whether for your future, your child’s future, or your financial freedom, you need to avoid the wrong ones first.

I’ve helped clients recover from bad buys. But I’d rather help you buy smart from the start.

Don’t buy blind. Get the list. Ask the hard questions. Talk to someone who has your back.

Message us now!

Before I recommend any property, I ask myself, would I buy this for my own family? If the answer is no, I’ll tell you the truth. Just because it’s new doesn’t mean it’s good. I don’t care how shiny it looks. If it doesn’t work, I’ll say no.

That’s my promise to you.