You Might Regret Later If You Ignore This!

Josh Tay

Last Updated on 08-Aug-2025

Melbourne home values are down 6.9% from their March 2022 peak, representing a median price drop of approximately $57,500. The question is:

Will you seize this opportunity or regret missing out?

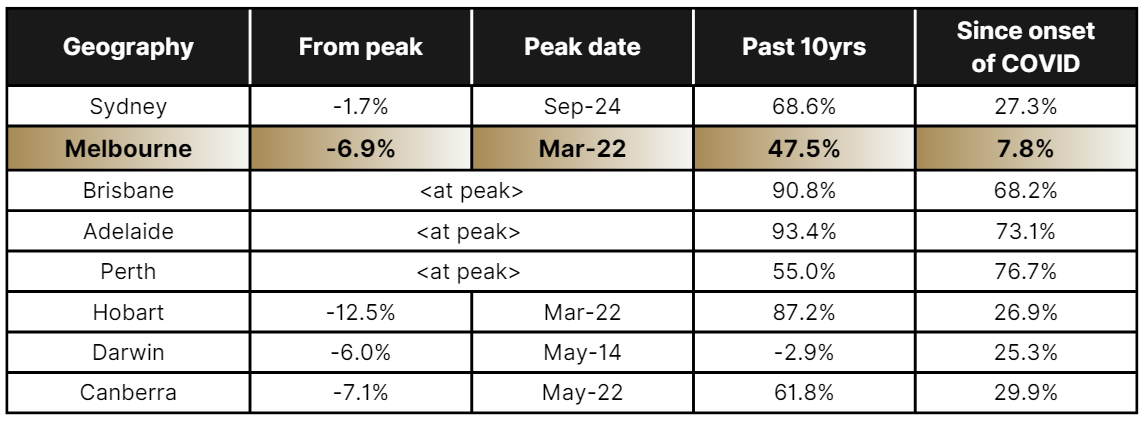

Change in dwelling values over key time periods:

Melbourne Property Prices: The Decline You Should Be Paying Attention To

Melbourne has recorded the most significant decline among Australian capital cities in recent months.

Change in Dwelling Values ( CoreLogic Home Value Index )

Released February 3rd 2025

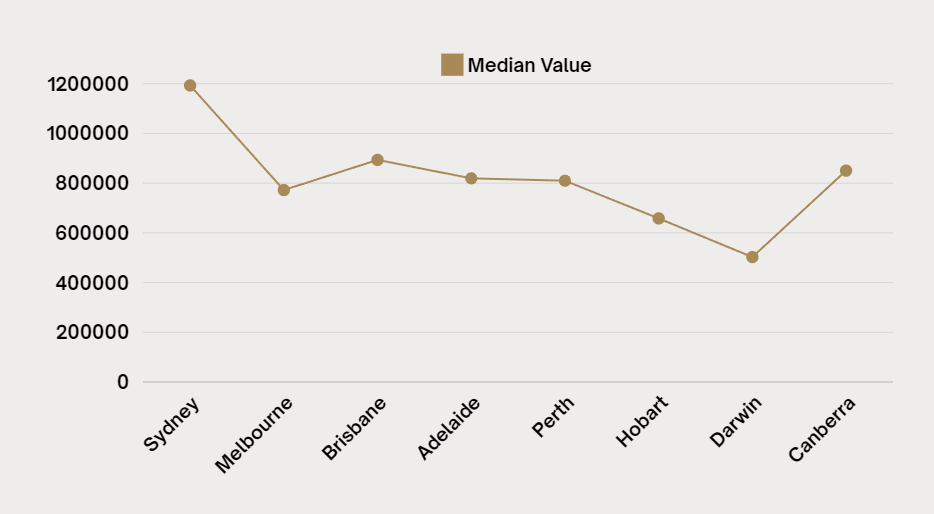

| City | Month | Quarter | Annual | Total Return | Median Value |

| Sydney | -0.4% | -1.4% | 1.7% | 4.8% | $1,193,228 |

| Melbourne | -0.6% | -2.0% | -3.3% | 0.4% | $772,317 |

| Brisbane | 0.3% | 1.2% | 10.4% | 14.7% | $893,592 |

| Adelaide | 0.7% | 1.8% | 12.7% | 16.9% | $819,363 |

| Perth | 0.4% | 1.0% | 17.1% | 22.3% | $809,870 |

| Hobart | 0.0% | -0.8% | -0.4% | 3.9% | $658,180 |

| Darwin | 0.6% | 1.7% | 0.9% | 7.5% | $502,632 |

| Canberra | -0.5% | -0.5% | -0.5% | 3.8% | $850,534 |

| National | 0.0% | -0.3% | 4.3% | 8.3% | $814,293 |

- Property values dropped 0.6% in January alone, compared to 0.4% in Sydney and 0.5% in Canberra.

- Over the past 12 months, Melbourne property values have fallen by 3.3%.

- Compared to its peak in March 2022, Melbourne prices are now 6.9% lower.

| If you’re a Singaporean investor, compare this to Singapore’s property market, where prices have remained sky-high, and the Additional Buyer’s Stamp Duty (ABSD) is eating into returns. This could be your golden ticket to an asset without the hefty tax burden. |

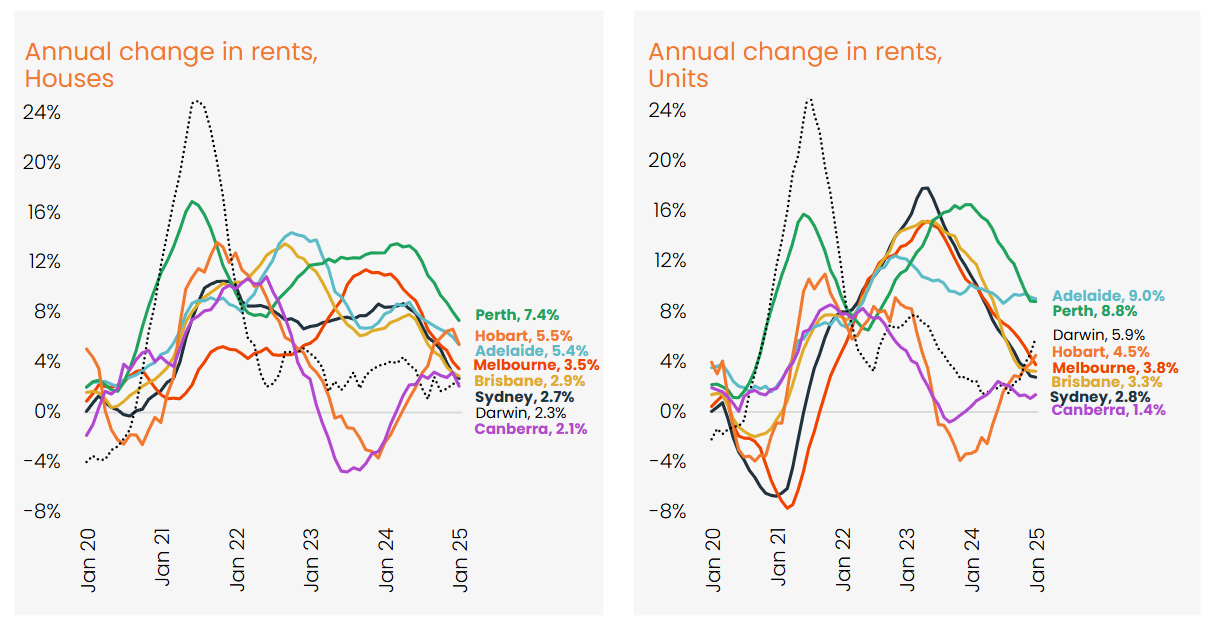

Rents Are Still Rising — A Sign of Strong Demand

While property values are adjusting, rents have continued to climb:

- Rents increased by 0.4% in January across Australia, with Melbourne seeing a modest rise.

- Over the past three months, regional rental growth (+1.6%) has outpaced capital city rental growth (+0.3%).

- Despite the slight softening in demand, rental yields remain attractive at 3.8% in Melbourne.

| If you’re buying for rental income, Melbourne offers a compelling balance of affordability and consistent tenant demand. With migration picking up, expect demand for rentals to surge further! |

Market Trends: Is Melbourne Becoming a Buyer’s Market?

- Listings in Melbourne have increased by 7.7% over the past year, giving buyers more options.

| This is the classic formula for a buyer’s market: lower prices, more listings, and motivated sellers. Investors who move now can negotiate better deals before competition picks up. |

Interest rate cuts in 2025 could stabilize property prices and drive demand up again:

| If you wait until rates drop, you’ll be buying at higher prices when demand surges. Act now while others are still sitting on the fence! |

If you’re after rapid capital growth and strong rental returns, Perth is worth considering. However, Melbourne offers long-term stability and international demand, making it a safer bet for conservative investors. |

Melbourne property values have dipped, but history tells us this won’t last forever. The moment interest rates start dropping, demand will rebound, and prices will follow. Investors who buy now will benefit from:

But here’s the catch: If you wait too long, you risk missing out on Melbourne’s bottom prices. The choice is yours — take action now or watch from the sidelines as others reap the rewards. |

If you’re serious about securing a high-potential investment in Melbourne or Perth, connect with us now! Let’s discuss your investment goals and find the right property before prices climb again.