Breaking News: The RBA Has Cut Rates Again

Josh Tay

Last Updated on 08-Aug-2025

In March 2025, after the Reserve Bank of Australia’s first interest rate cut in February, I predicted that further reductions would come around June or July. In fact, I highlighted this acceleration just two weeks ago in my latest article. But the RBA surprised us all—the second cut arrived much earlier than expected.

Earlier-Than-Expected Rate Cuts

This is huge. A 0.25% rate cut can boost your borrowing capacity by around $12,000, which can be the difference between settling for less or securing your ideal property.

It marks the first back-to-back easing cycle in years. The cash rate may drop further to 3.35% by year-end, depending on inflation and global conditions.

Why does this matter?

Because interest rate cuts make borrowing cheaper — which directly fuels buying activity. And as history shows, once the market realizes rates are heading downward, prices start climbing upward.

| Date | Cash Rate After Cut | Basis Points Cut | RBA Commentary |

| Feb 2025 | 4.1% | 25 | First cut since 2022 tightening cycle |

| May 2025 | 3.85% | 25 | Inflation easing, global risks rising |

Bank Moves Confirm the Trend — Fixed Rates Are Already Falling

In anticipation of the RBA’s cuts, Australia’s major banks began slashing fixed-rate mortgage products months ago. Now with the official cut confirmed, banks like Macquarie, CBA, NAB, and ANZ have started passing on the full reduction to borrowers.

This provides immediate relief for mortgage holders, with average savings of around $80 per month on a $500,000 loan after two cuts.

Buyers are re-entering the market aggressively.

Developers are pushing inventory quickly — especially land estates in Perth, where titled land starts from just $331,000.

Yes, you read that right. Titled. Ready to build. From $331k.

Compare that to Singapore, where a mere BTO flat can cost over SGD $600,000, or where a shoebox condo unit can run above SGD $1 million.

See the contrast? And it gets better.

Melbourne Demands your Attention Right Now

Melbourne’s property market is at a cyclical low, with median dwelling values around $781,000–$786,000—making it the second cheapest among the five major capitals, just ahead of Perth.

Melbourne property values have shown modest growth in 2025, with a 0.2% increase in April and a 1.0% rise over the February–April quarter. However, values remain about 5.4% below their March 2022 peak.

| Timeframe | Property Price |

| Monthly (April 2025) | +0.2% |

| Quarterly (Feb-Apr 2025) | +1.0% |

| Since Peak (March 2022) | -5.4% |

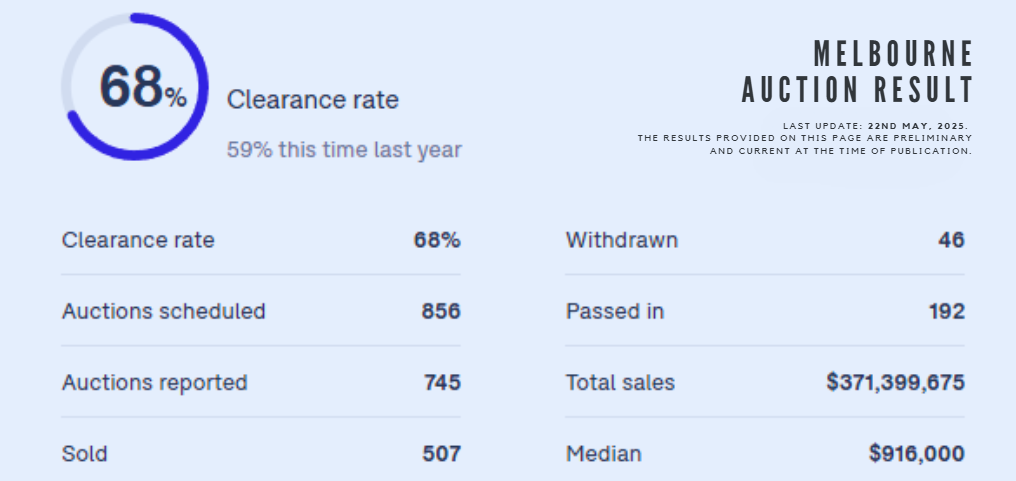

Auction clearance rates are strong, with a recent rate of 68% (week ending May 17, 2025), up from 59% a year ago. Preliminary rates have even reached above 70% in some recent weeks.

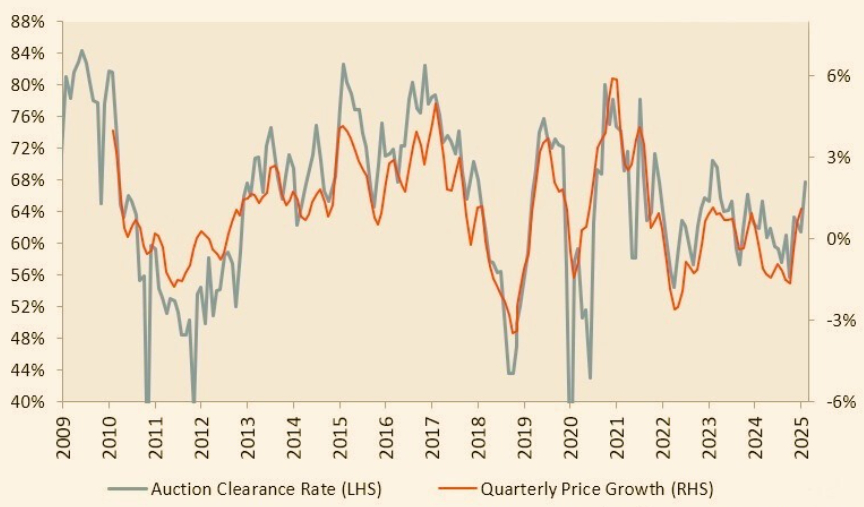

Melbourne Auction Clearance Rate vs Price Growth

Buyer Confidence

Buyer confidence is returning. According to NAB’s Q1 2025 Property Survey, 44% of buyers believe Victoria is at the start of a recovery, supporting your statement about returning buyer confidence.

Melbourne continues to attract both local and international buyers, including Singaporeans, due to its affordability, strong rental demand, and capital growth potential. Rental yields in some suburbs are competitive, and the favorable exchange rate further incentivizes foreign investment.

Gross rental yields have improved to 3.7% (up from 3.5% last year), and rents are rising faster than wages and inflation. The rental market is under significant pressure due to high demand and low vacancy.

| Location / Sector | Gross Rental Yield (%) | Notes |

| National (Australia) | 3.73% | Highest in two years as of April (reported by CoreLogic) |

| Melbourne (Units) | 4.80% | 37 basis point increase in gross yield |

| Regional Australia | 4.41% | Substantially higher than the national average |

| Melbourne (Rental Growth) | ↓ from 9.4% to 2.0% | Sharp drop in annual rental growth |

Ready to Dive Deeper? Explore More About Melbourne’s Property Market

To truly understand why Melbourne is such a compelling opportunity right now and for a deeper dive into Melbourne’s market dynamics, I invite you to read these insightful articles:

If you’re considering your options and wondering why Singapore’s savvy investors are shifting their focus to Melbourne’s house and land market—or whether townhouses, apartments, or houses are right for you—these reads will help you decide:

Why Are Singapore’s Savvy Investors Shifting to Melbourne’s House & Land Market?

Townhouses, Apartments, or Houses in Melbourne: Which Option is Right for You?

For ongoing updates, expert insights, and the latest market trends, I encourage you to explore the full range of blogs I’ve created to keep you informed and ahead of the curve:

Explore More Australian Property Insights

If you wait — you’ll face, higher prices, lower yields, and fewer good units to choose from. But if you act now, you get first-mover advantage, better borrowing rates, and greater long-term growth.

It could be the home your daughter stays in while she studies law in Melbourne, the land you retire on, or this could be the first of many income-generating properties in your legacy portfolio.

You’re building freedom, options, a future.

Let’s make it happen, message us now!